The Difference Between Forex and Binary Options Trading

Understanding the differences between Forex trading and binary options trading is crucial for novice traders looking to make informed investment decisions. While both have their unique features and benefits, they fundamentally differ in how they operate, the risk involved, and the potential returns they offer.

Nature of the Markets

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs to profit from their fluctuations in value relative to each other. It is a complex market with deep liquidity, allowing for the continuous trade of currencies 24 hours a day during weekdays. Forex offers high variability in terms of trading strategies and levels of risk, suitable for both beginners and experienced traders.

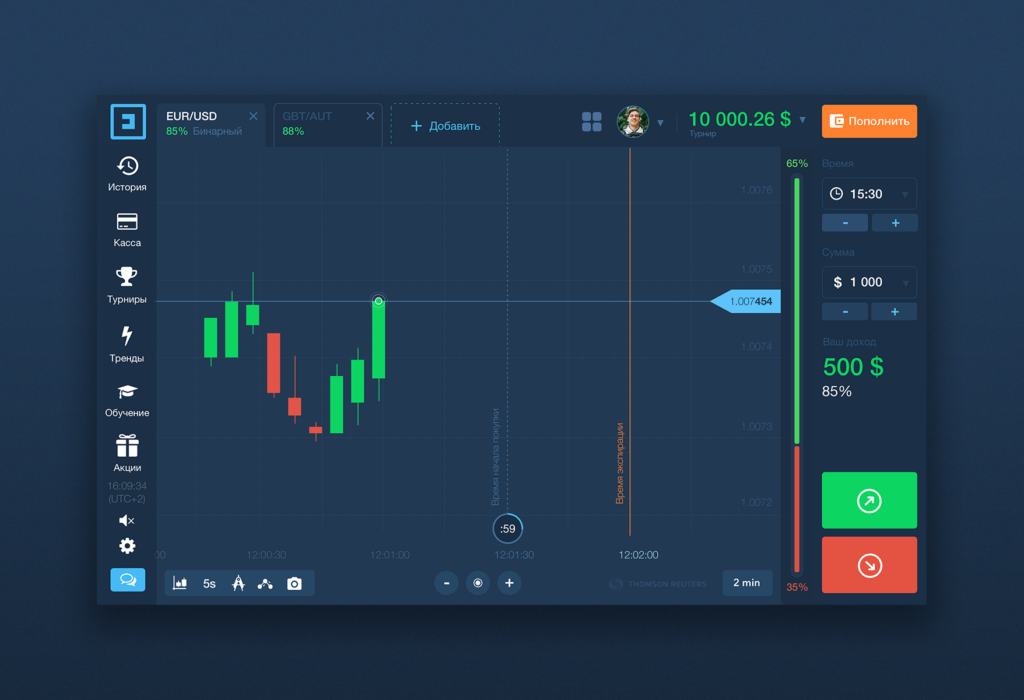

Binary options trading, on the other hand, is relatively simpler. Traders bet on the price movement of an asset, like a currency pair, over a short period. They predict whether the price will rise or fall at a certain point in time. The outcome is binary: either you win a preset amount or lose your initial investment. Due to its “all or nothing” nature, binary options trading can be more predictable in terms of potential loss or profit.

Risk and Returns

Regarding risk and returns, Forex trading offers an adjustable risk approach. With proper strategy and risk management, a trader can limit exposure while potentially maximizing gains. Forex trading allows leveraging, which can amplify both profits and losses. Still, with tools like stop-loss orders, traders have better control over their risk exposure.

Binary options trading provides a fixed risk and reward. From the onset, traders know exactly how much they can win or lose from a trade. This can shield against unexpected volatility but also caps potential earnings. Furthermore, some critics argue that binary options trading can resemble gambling more closely than investing.

Timeframe and Flexibility

Another vital difference lies in the operational timeframe and flexibility of trading. Forex trading can accommodate various trading styles, from day trading and scalping to swing trading and position trading. This flexibility allows traders to adjust their strategies based on market conditions and their personal time availability.

Binary options trading is generally more constrained. It requires traders to choose from preset expiration times which can range from minutes to days. This rigid structure can limit traders’ control over their trades and reduce opportunities for adjusting positions in response to market changes.

Conclusion

In conclusion, while both Forex and binary options trading offer avenues for speculation in financial markets, they cater to different trader types. Forex provides a complex, highly liquid market with opportunities for strategic, long-term investments and benefit from market volatility. Conversely, binary options offer a simpler, more predictable way to trade with fixed risks and returns, appealing to those looking for quick and clear-cut trading outcomes. Understanding these fundamental differences will help you choose the path that best fits your trading style and goals.